Accruals are not the same as provisions both are totally different from each other. Accruals and provision both are vital parts of accounts but work differently Accrual Accrual expense means the transaction that takes place in a particular period must be accounted for in that period only irreRead more

Accruals are not the same as provisions both are totally different from each other. Accruals and provision both are vital parts of accounts but work differently

Accrual

Accrual expense means the transaction that takes place in a particular period must be accounted for in that period only irrespective of the fact when such an amount has been paid.

An accrual of the expenditure which is not paid will be listed in the books of accounts. These accruals can be further divided into two parts

Accrual Expense

Accrual Expense means any transaction that takes place in a particular period but the amount for it will be paid on a later period.

For example- 10,000 for the month of March was paid in April month then this rent will be accounted for in the books in March

These are the following accrued expense

- Accrual Rent– Accrual rent means the amount for using the land of the landlord is paid at a later period than the period when it is put into use.

- Insurance– Accrual insurance means the amount paid as a premium to the insurance company paid on a later period than the period when it is due

- Expense- Acrrual expense means the amount for any expense paid on a later period then the period when it pertains to be paid

- Wages- Accrual wages means the amount which is paid to employees on a later period than the period when the wages get due

Accrual Revenue

Accrual Revenue means any transaction that takes place in a particular period but the amount for it will be received on later period. For example- If interest of 10,000 on bonds for the period of March is received in April months then this amount will be accounted for in March. These are the following accrued revenue

- Accrual Rent– Accrual rent means the amount for using the land of an entity by another party is received on a later period than the period when it was put into use.

- Accrued Interest– Accrued interest means the amount of interest received on a later period than the period when it pertains to receive

PROVISIONS

Provision refers to making a provision/allowance against any probable future expense that the company might incur in the near future. This amount is uncertain and difficult to predict its surety.

However, as per the prudence concept of accounting a company needs to anticipate the losses that will incur in the near future due to which provision is made.

For example- A company has debtors of 10,000 but as per the company’s previous records company anticipates that 1% of debtors will become bad debts. So in this case company will make a provision of 1% that is 100 on it.

There are various types of provisions which are-

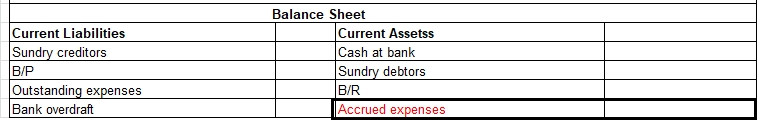

- Provision on Depreciation– Provision for Depreciation means a provision for future depletion of assets has been already created

- Provision for Doubtful Debts– Provision for Doubtful Debts means a provision created against debtors that doesn’t seem to be recovered in the near future

Definition Debit balance may arise due to timing differences in which case income will be accrued at the year's end to offset the debit. The amount is shown in the record of a company s finances, by which its total debits are greater than its total credits. The account which has debit balances are aRead more

Definition

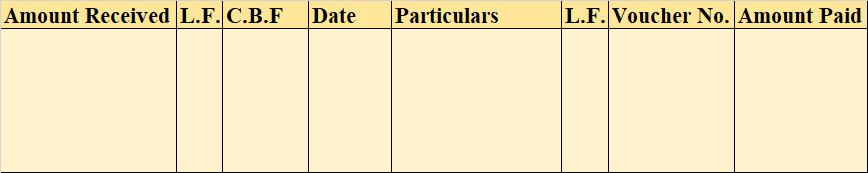

Debit balance may arise due to timing differences in which case income will be accrued at the year’s end to offset the debit.

The amount is shown in the record of a company s finances, by which its total debits are greater than its total credits.

The account which has debit balances are as follows:

• Assets accounts

Land, furniture, building machinery, etc

• Expenses accounts

Salary, rent, insurance, etc

• Losses

Bad debts, loss by fire, etc

• Drawings

Personal drawings of cash or assets

• Cash and bank balances

Balances of these accounts

In class 11th, we learned about all these accounts that have debit balances.

Where the total of the debit side is more than the credit side therefore the difference is the debit balance and is placed credit side as “ by balance c/d “

Here are some examples showing the debit balances of the accounts :

See less